Just as the recent release of Oppenheimer has rekindled a fascination with the processes behind the invention of the atomic bomb, an analogous transformational event takes place in the world of investment management - the construction of top-down systematic factor models. As we navigate this universe, we encounter two distinct models that dominate the discourse: the time-honored Fama-French Model and the emergent Premialab Pure Factors®.

In the Pursuit of Returns: Fama-French

In the way Oppenheimer, the ‘father of the atomic bomb,’ radically expanded our understanding of nuclear physics, Eugene Fama and Kenneth French in 1993 broadened our comprehension of asset pricing. They built upon the Capital Asset Pricing Model (CAPM), enhancing it to incorporate three factors: market risk, size, and value. This model evolved further in 2015, gaining additional complexity with the inclusion of profitability and investment. These ingredients serve as representations of various factors from the macroeconomic realm, firm-level characteristics, and market-wide variables, painting a comprehensive picture of risk sources in returns.

The Emergent Innovator: Premialab Pure Factors®

Turning our gaze to the Premialab Pure Factors® model, we witness a different paradigm. It is akin to a collective intelligence of over 5,000 liquid systematic strategies drawn from eminent index providers, spanning diverse asset classes. The equivalent to the interdisciplinary synergy that drove the creation of the atomic bomb, this approach leverages a consensus of banks’ implementations, constructing an independent benchmark for systematic risk factors.

A Tale of Two Models: Comparative Analysis

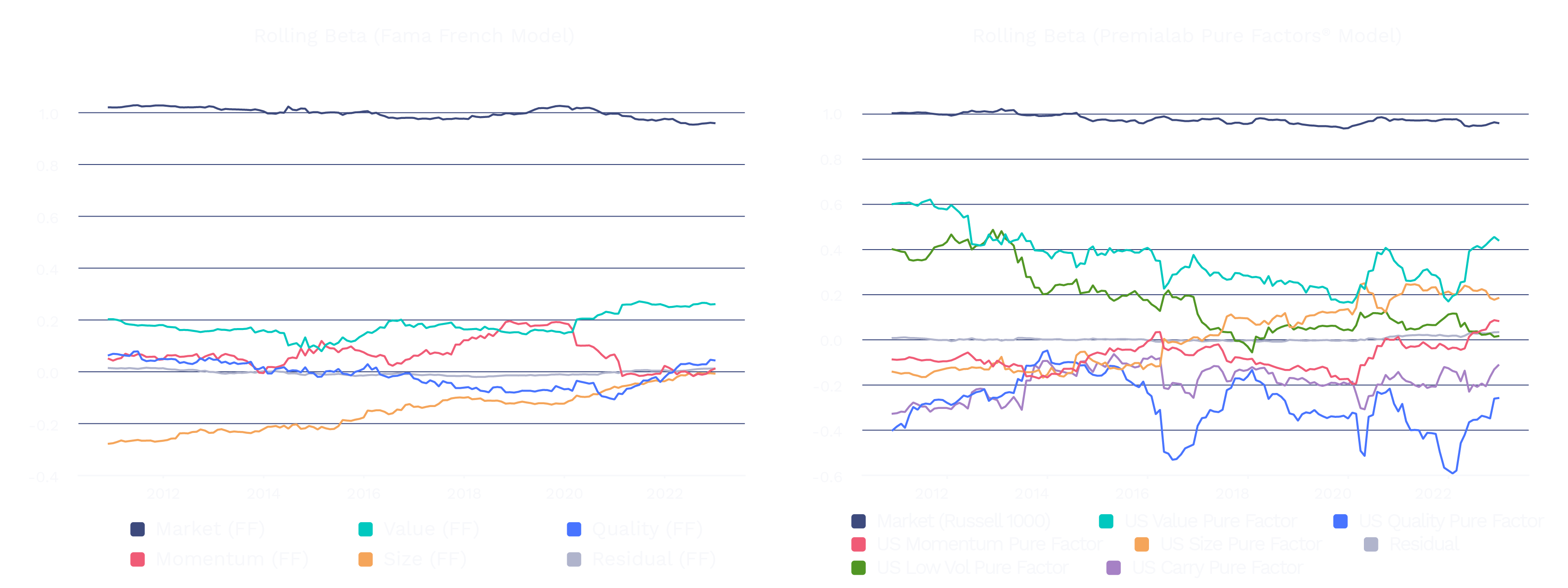

To test drive these models, we put the Vanguard Windsor II fund under the microscope, employing the four-factor Fama-French model alongside the full set of Premilab factors. Picture this as a rolling race on a 70-month track with the market factor as the engine.

While the Fama-French model identifies the fund as primarily value driven, accounting for the return drag between 2018 and 2022, Premialab shines additional light on the negative quality exposure, providing an enhanced level of transparency. Using Fama-French shows a relatively neutral exposure to Quality over this period, which means this tilt has been missed in the resulting return attribution. Additional factors provided by Premialab, like Carry and Low Vol, give us a clearer view of the fund’s and market’s dividend profile and volatility exposure, driving us closer to understanding total return over the evaluation period.

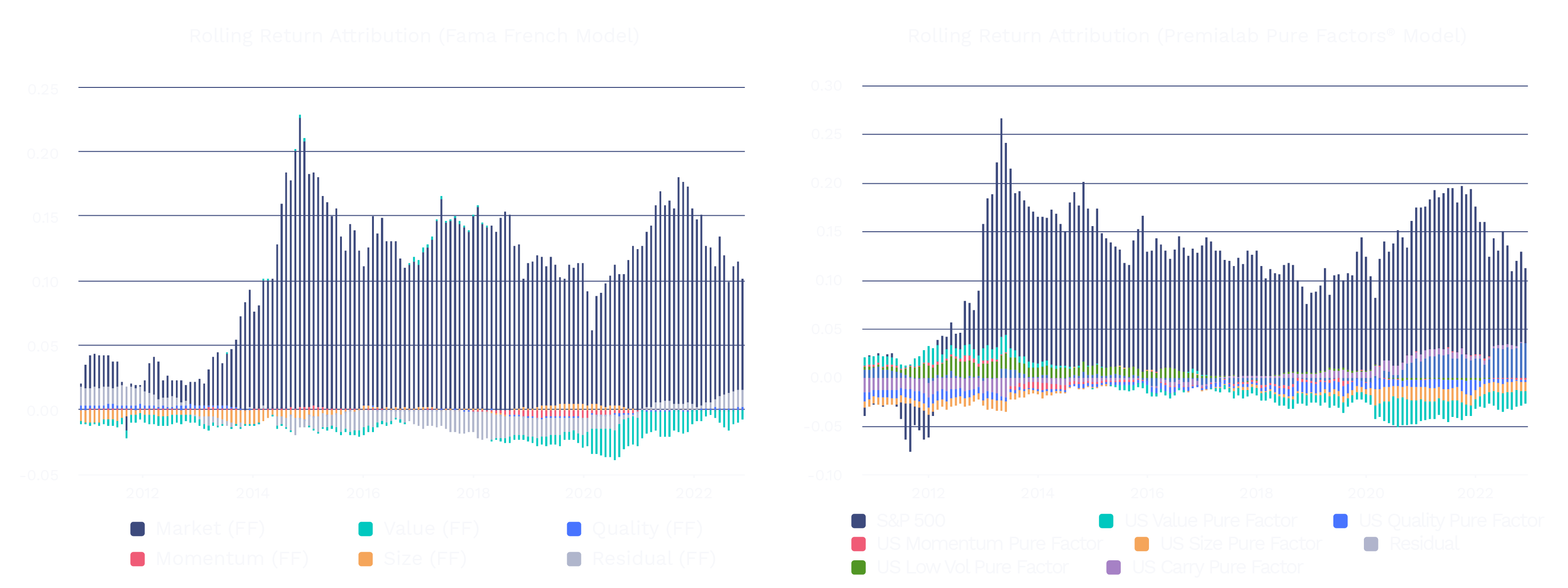

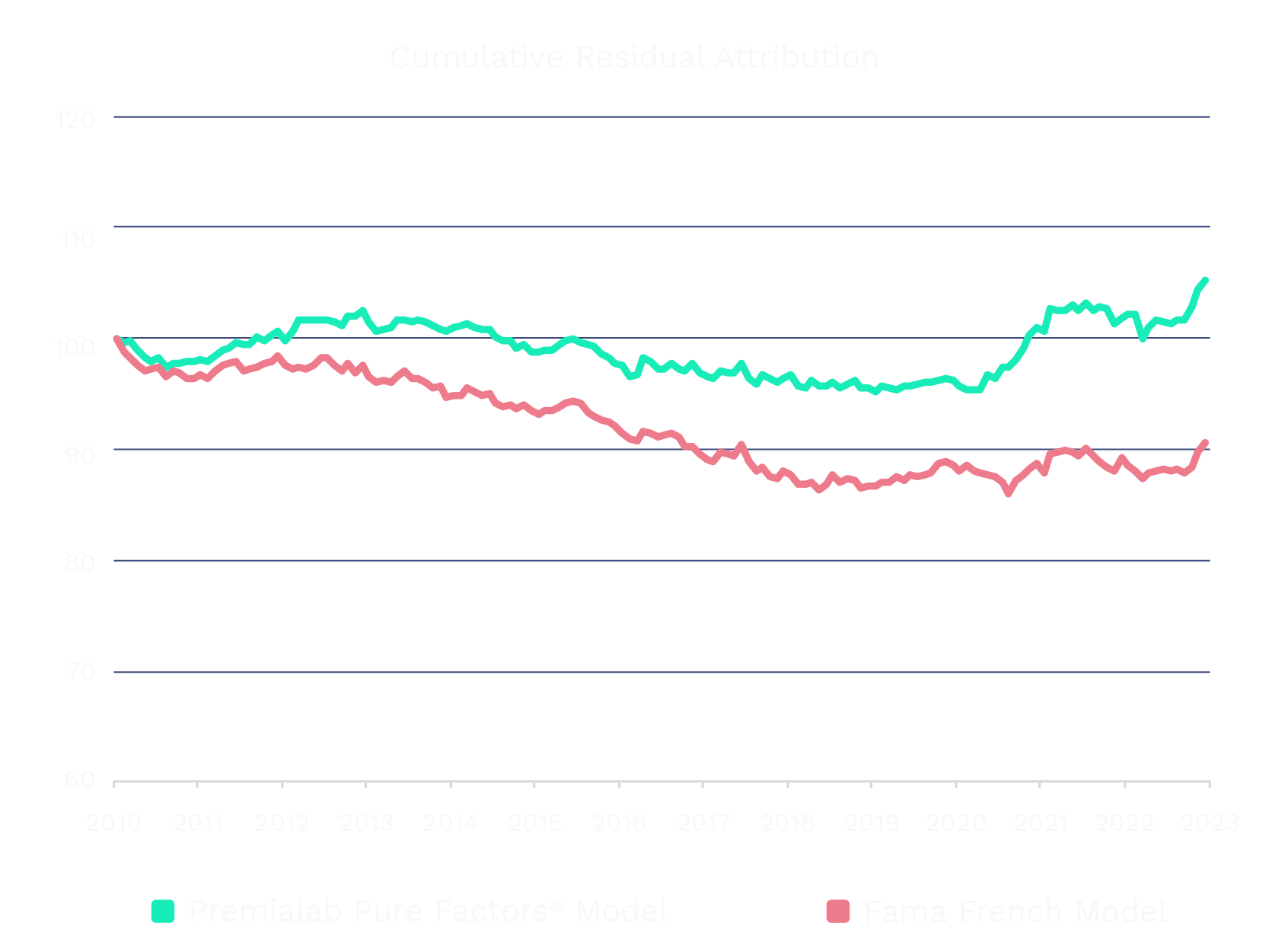

If we focus on the cumulative performance attribution of the residual, we can observe that Fama-French model explains only 90% of the fund’s performance over the period. The more granular and potentially fairly priced Premialab Pure Factors® model captures close to 100% of the fund’s performance during this period.

Distinguishing Features

Much like the unique characteristics of atomic particles, these models have distinct features:

- Domain Specialization vs Multidisciplinary Approach: The Fama-French model largely concentrates on equity markets, demonstrating proficiency in this area. The Premialab model, however, manifests a more diversified, multidisciplinary approach, covering a spectrum of asset classes.

- Academic Rigor vs Adaptive Innovation: Fama-French factors originate from academic research aimed at explaining stock returns, whereas Premialab factors stem from a consensus of implementations, offering a dynamic response to shifting market trends.

- Benchmarking Proficiency: Premialab also offers the ability to use consensus factors as an independent judge to evaluate different strategies, making it a useful benchmarking tool.

- Detecting Hidden Exposures: Another unique feature of the Premialab model is its capacity to identify cross-asset exposures in equity portfolios, a feature not inherent in the Fama-French model.

- Liquidity and Trading Costs: Being based on live traded strategies gives Premialab Pure Factors® the added feature of accurately reflecting these key market features.

Choosing the Right Model

In summary, both models serve as essential methodologies for explaining fund returns. Nevertheless, while the Fama-French model offers a robust and established framework for equity markets, the Premialab model presents a versatile, adaptive approach, capturing multiple asset classes and liquidity considerations. Hence, akin to selecting the right tool for a scientific experiment, the choice between these models should align with the specific requirements of the portfolio and the desired depth of factor decomposition.

To learn more about Premialab’s statistical and analytical methodology to benchmark and classify the universe of Quantitative Investment Strategies (QIS) deployed in the market, download the Advanced Factor Analytics white paper.