Over the past decade, institutional investors are facing significant uncertainty in navigating markets. Rising geopolitical risks, persistent inflation, and shifting interest rates have driven allocators towards multi-strategy hedge funds (multi-strats) in hopes of bringing consistency to their portfolios. These funds provide a one-stop solution for uncorrelated performance and target absolute returns, regardless of market environment. The strength of the multi-strat model lies in its market-neutral positioning and ability to generate idiosyncratic returns. This approach to portfolio construction and management is characterized by three core features:

-

Comprehensive risk management: Central risk teams monitor overall portfolio metrics like leverage, VaR, exposures, and drawdown levels, intervening when necessary to manage risks and exposures.

-

Alpha generation: Top investment teams are brought on based on their specialized expertise in specific markets. These teams are expected to deliver a variety of diversified alpha sources within the specified parameters of the fund.

-

Limiting Correlation: Investments made by managers are monitored to limit correlation within the platform to prevent concentration and large overlaps.

Multi-strats that effectively leverage these attributes have consistently demonstrated strong performance, combining high returns with low volatility. However, the headline statistics only tell part of the story. A significant portion of the outperformance in multi-strats is driven by those that are closed to new capital, leaving most investors with access only to the relatively lower returns of funds that have capacity. Over the past 12 months, allocators have also increased their scrutiny of multi-strats, calling for greater transparency, looser lock-up periods, and cash hurdles before being charged incentive fees. This has led to a growing misalignment of interests between the expectations of many institutional investors and fund managers. The divide raises a critical question: What are the options for investors looking to generate diversified alpha without dealing with the drawbacks presented in these multi-strats?

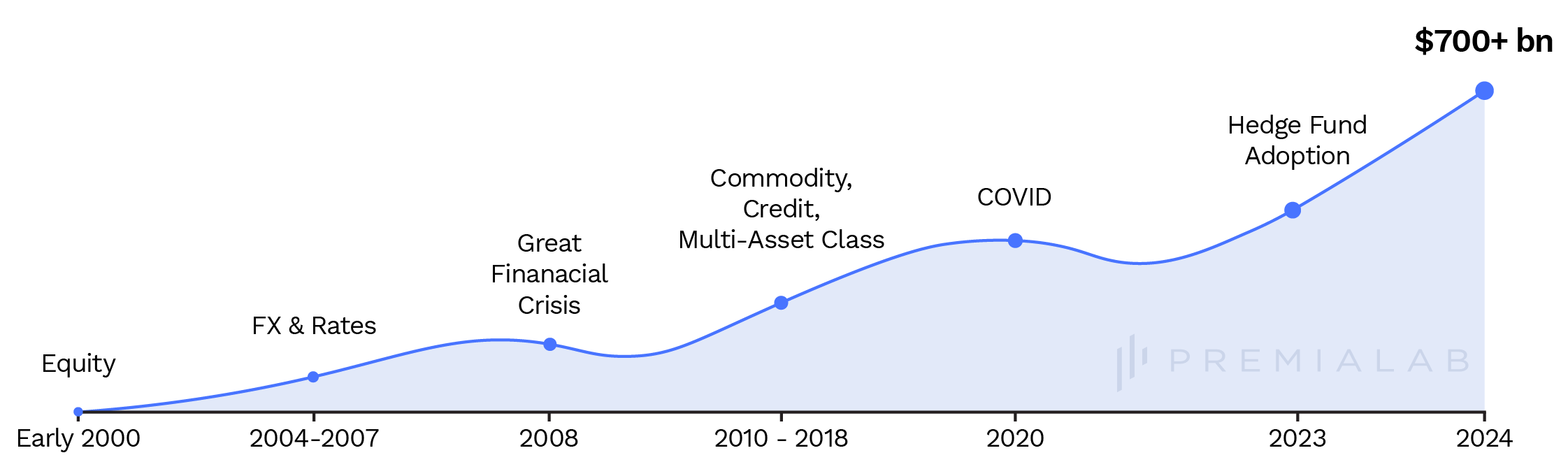

Quantitative Investment Strategies (QIS) have gained popularity for their ability to cover a broad multi-asset universe through systematic long/short trading. While QIS can be designed to capture specific risk premia, their value extends further by offering broader capabilities, including products that support portfolio optimization, hedging, and outperforming benchmarks. As more use cases emerged, the QIS market experienced significant growth over the past several years with the current market estimated at over $700 billion in AUM.