Foreign Exchange (FX) has historically been overshadowed by the allure of stocks and bonds, earning its reputation as a slower-moving market, often overlooked by investors seeking alpha. However, as expectations for global rate cuts intensify, investor interest is being shifted towards FX as a new avenue for alpha generation.

The 2024 carry trade crash stems from shocks in the Japanese Equity market – which triggered broader sell offs, drawing attention to the critical role of currency markets. The yen’s appreciation against the greenbacks has had far-reaching consequences beyond Japan’s borders, sparking a wave of deleveraging among global investors. Global investors scrambled to adjust their positions, many of whom unwound their yen-denominated carry trades. This mass unwinding has injected additional volatility into global markets, the effects of which were felt across asset classes as this very piece was being written. The ripple effect from the yen’s movement is a stark reminder of the critical role currency markets play in global finance, prompting investors to reassess their risk management approaches. In response to these market dynamics, FX investors are adopting different implementations to capitalize on the currency movements.

This market volatility also draws attention to the rise of emerging markets (EM) as a new frontier for FX investors. Improved access to macroeconomic data has facilitated easier entry into these markets, with investors looking to diversify their currency exposure beyond their traditional developed markets. Investment banks are responding to this trend by creating systematic currency indices, named Quantitative Investment Strategies (QIS), designed to navigate these complex markets more effectively.

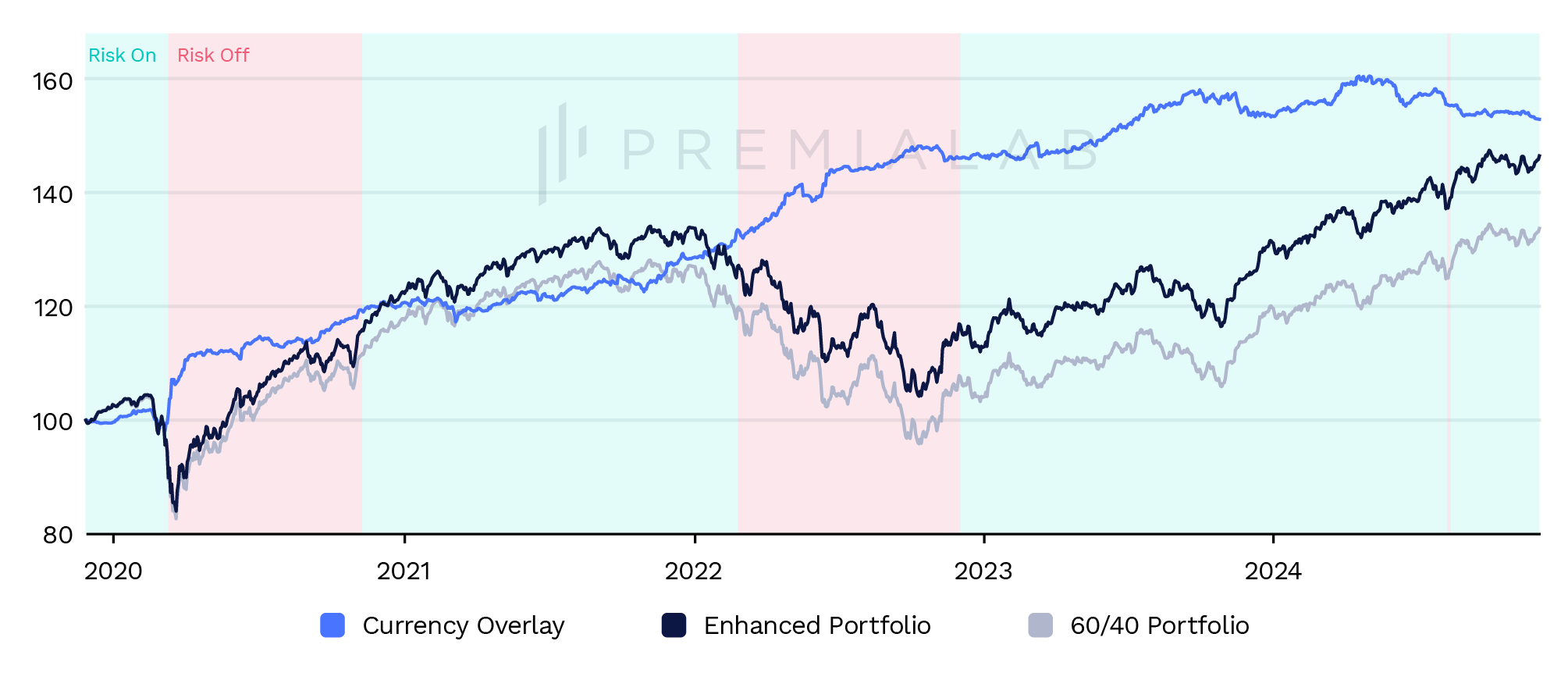

However, navigating this market comes with its own set of challenges, currency risk standing out as a primary concern. Exchange rate fluctuations can have a significant impact on portfolios heavily exposed to foreign securities. Currency overlays have emerged as an effective hedge against inherent exposures and potentially generate hedged returns.

In light of these developments, this article offers a comprehensive roadmap for constructing a currency overlay with applications in global and emerging markets, and across risk factors. Leveraging Premialab’s database, benchmarking and portfolio construction tools, this article outlines the sequential steps involved in creating and monitoring a FX portfolio. The perspectives shared herein will be particularly relevant to institutional use cases aiming to optimize FX exposures, specifically delving into sensitivity measures to assess FX risk, and performance contribution.