In recent years, Quantitative Investment Strategies (QIS) have gained increasing popularity, offering a solution to the shortcomings associated with hedge funds. QIS provide investors with advantages such as lower fees, a transparent investment framework, and comparable market exposure to various hedge fund products. With multiple structural benefits, the QIS market has experienced consistent growth over the past years, with the current market estimated at over $700 billion in AUM.

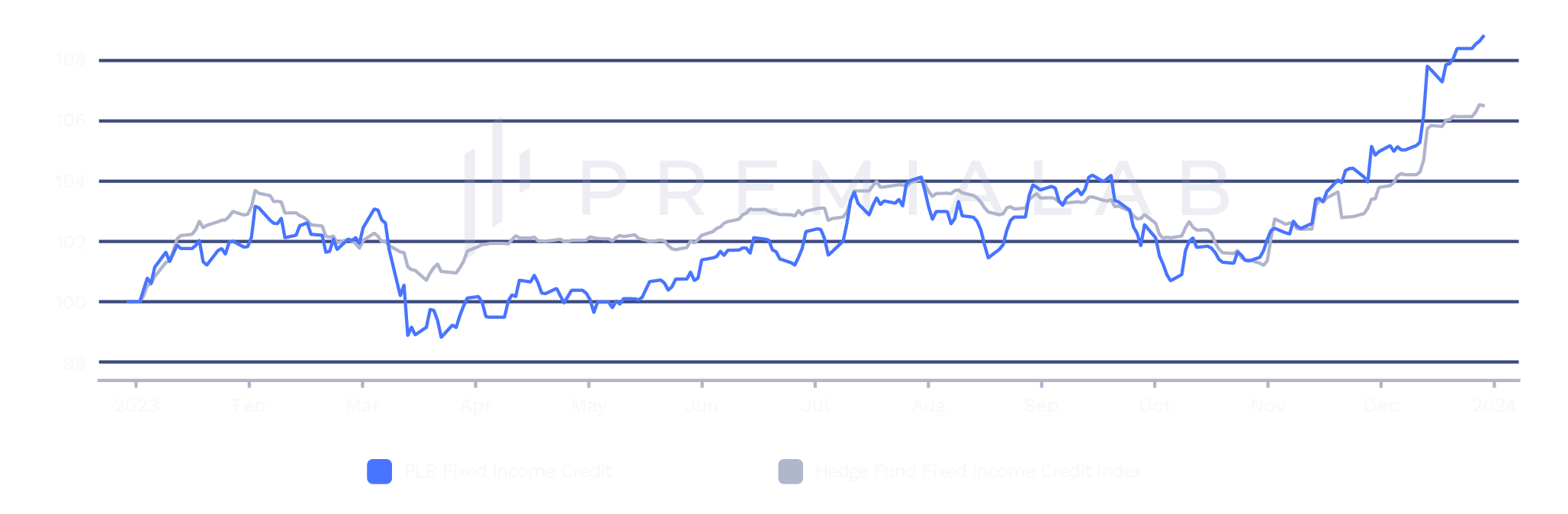

Recent performance comparisons across different indices have strengthened the argument for QIS, revealing their ability to outperform some of their hedge fund equivalents. This report aims to dissect and compare the effectiveness of QIS against a selection of comparable traditional hedge fund strategies. Leveraging Premialab’s extensive database, the analysis highlights the advantages QIS offers to investors, including the potential for stronger performance, enhanced liquidity, and transparency, and explains why QIS is becoming more prevalent in asset allocation, offering a compelling alternative and challenging established hedge funds.