2023 was an incredibly eventful year, with a combination of market events that presented a plethora of opportunities and challenges for investors to take positions. From the collapse of SVB to persistent high interest rates and geopolitical tensions, global factors played a pivotal role in shaping market dynamics.

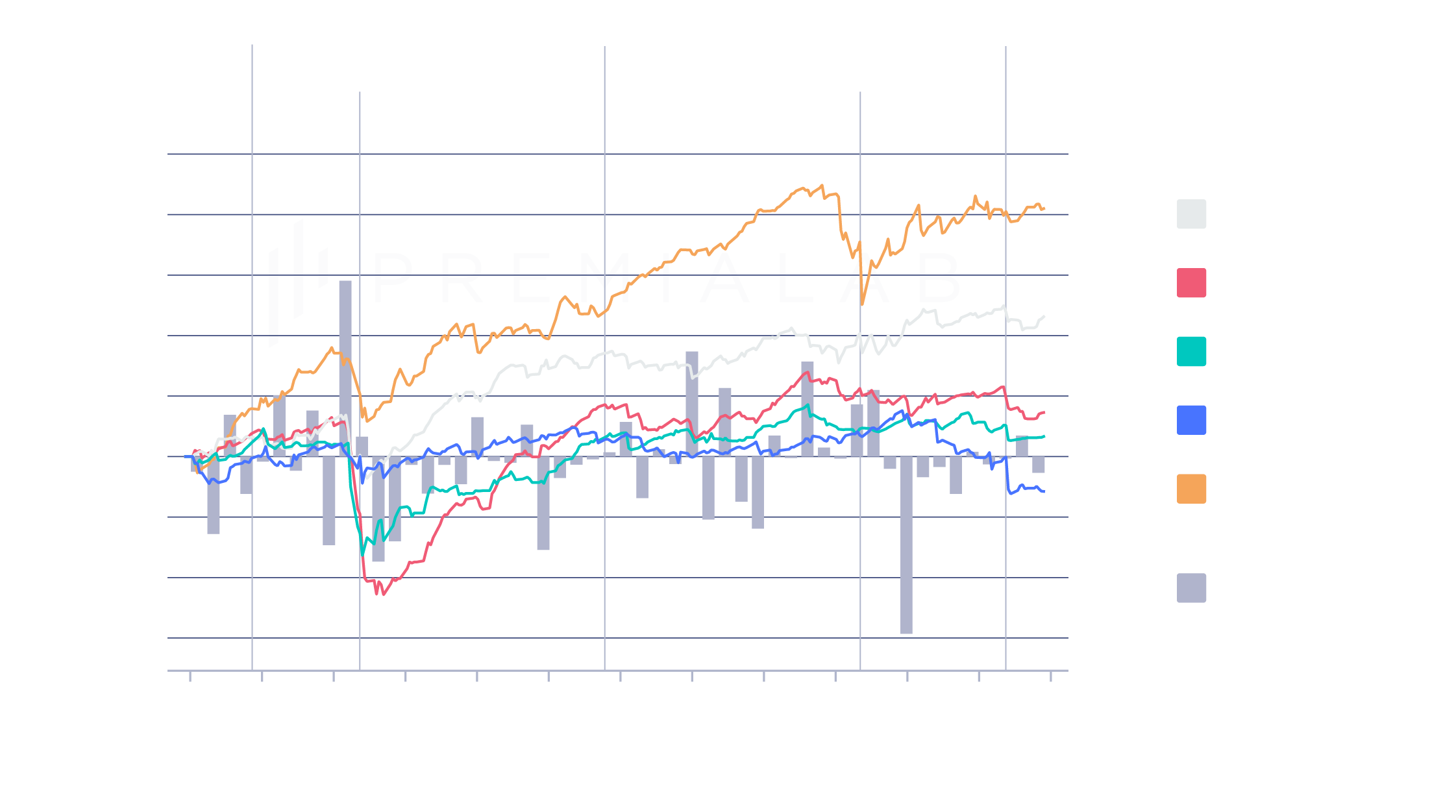

Europe’s equity market performed strongly, showing a gain of 15.88%, while the US market outperformed even more significantly with an impressive 25.75% increase. Commodities experienced mixed outcomes, with an overall decline of -7.93%, while Global Fixed Income excelled, particularly in European markets outperforming the US. In Credit markets, High Yield investments (9.36%) surpassed Investment Grade (8.54%), showcasing resilience amid economic uncertainties. Bond performance remained robust, serving as a safe haven during volatile market narratives dominated by stubborn inflation trends and central bank rate hikes.

Read the 2023 Factor Performance Review and Outlook article for comprehensive insights into the performance of key factors, such as Equity Market Neutral, Volatility, Multi-Asset Trend, FX Carry, and Commodities, and their comparison to the previous year. We explore the reasons why some factors excelled while others faced challenges in 2023, and with this perspective in mind, provide an outlook for 2024.