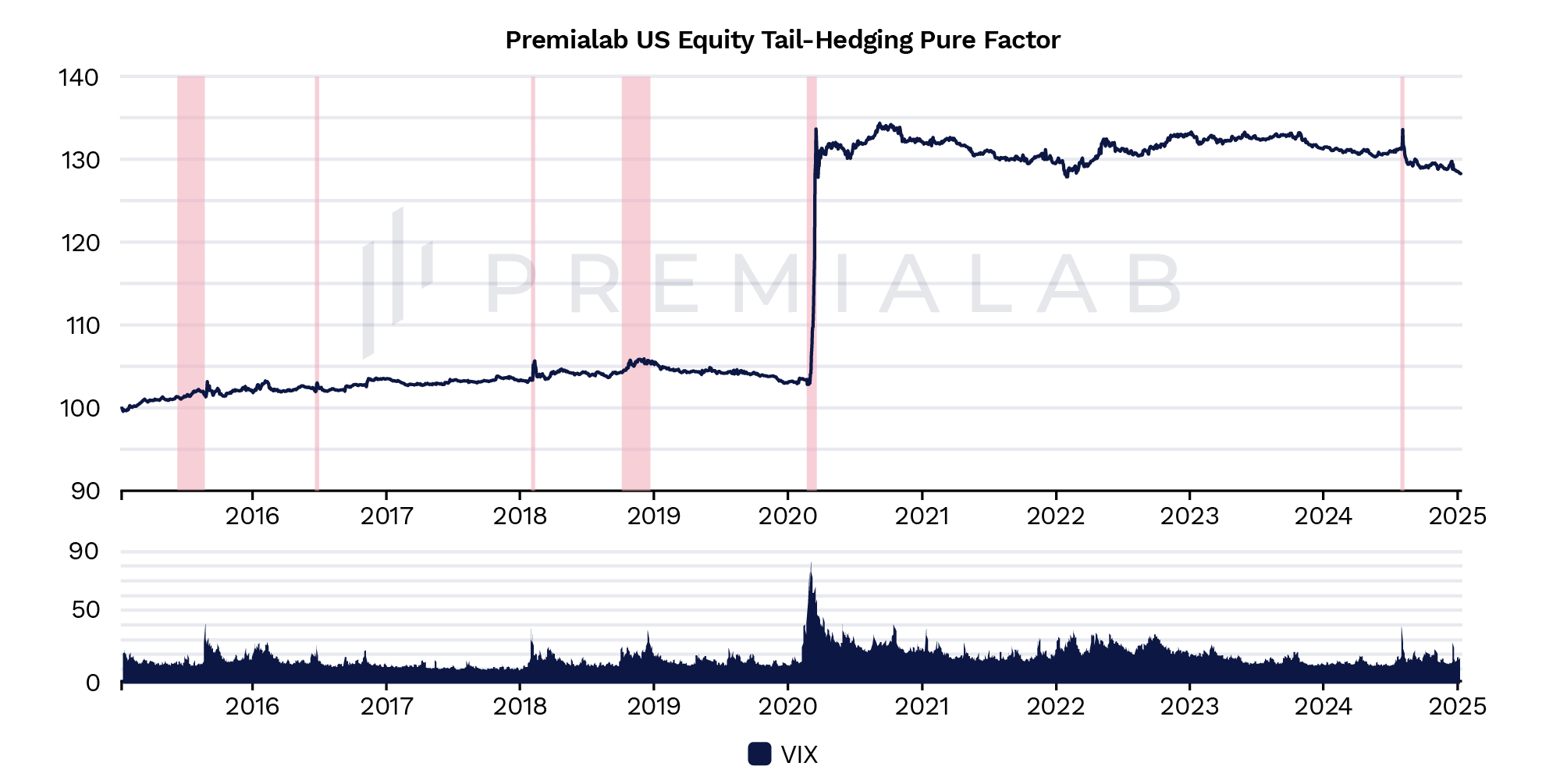

Bloomberg News’ latest article, “Wall Street Eyes Cheap Hedges for Stock Rally Showing Strains” highlights Premialab’s data, showcasing how QIS strategies can offer cost-effective tail-risk protection.

“Buy-side clients are increasingly incorporating long VIX calls and tail-risk hedging strategies into their portfolios,” said Adrien Geliot, Chief Executive Officer of Premialab. “These approaches enable clients to manage downside risks and protect against volatility spikes more efficiently in today’s volatile markets, often without the significant drag on returns associated with traditional hedging methods” he added.

Read the full article to find out how QIS trades are revolutionizing the finance industry, offering liquid, transparent, custom, and cost-efficient performance engines.