In this Bloomberg article on the surge in dispersion strategies, our CEO Adrien Geliot shared valuable insights on the accelerating growth of Quantitative Investment Strategy (QIS) products.

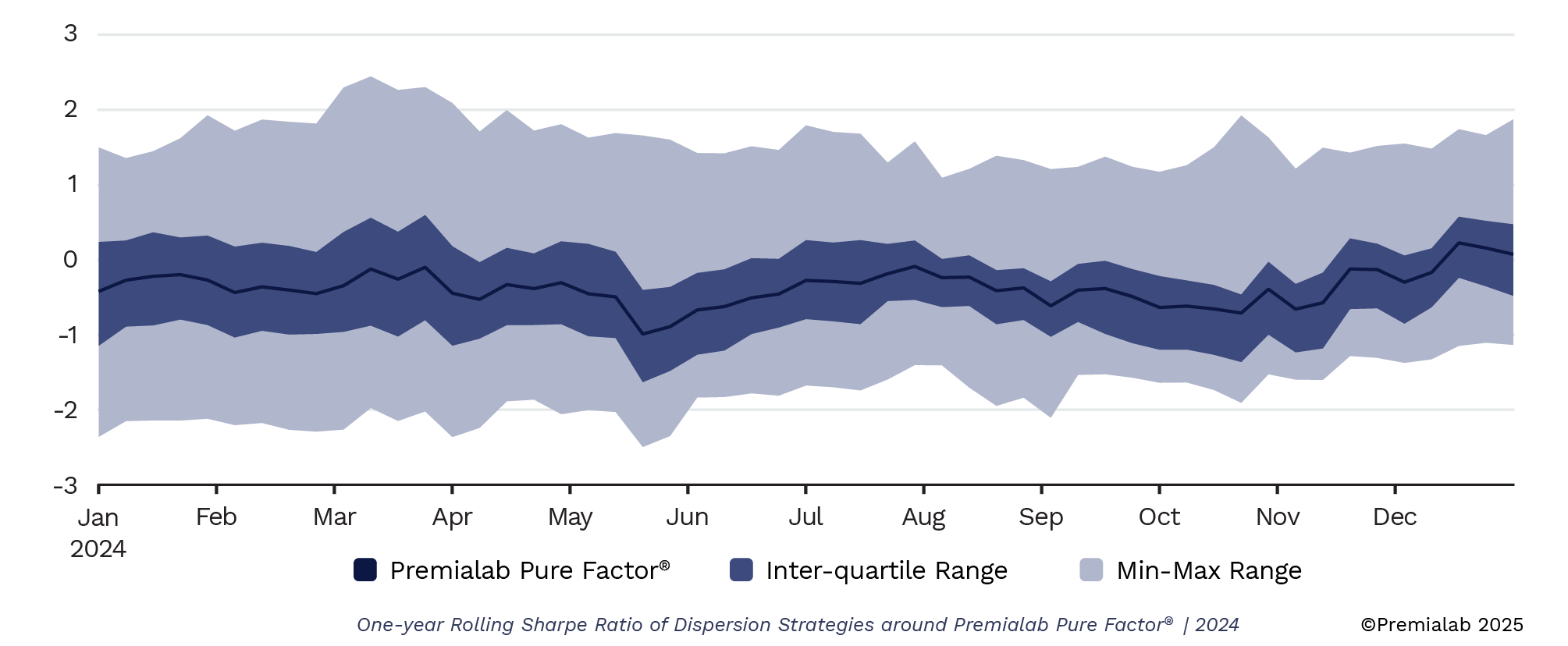

Demand for dispersion strategies continues to strengthen, with Premialab recording a 267% increase in these strategies in 2024 compared to 2023—representing a sharp acceleration from previous years.

To explore how QIS strategies can enhance your investment approach, please feel free to contact us.