Updated on 18 December, 2024

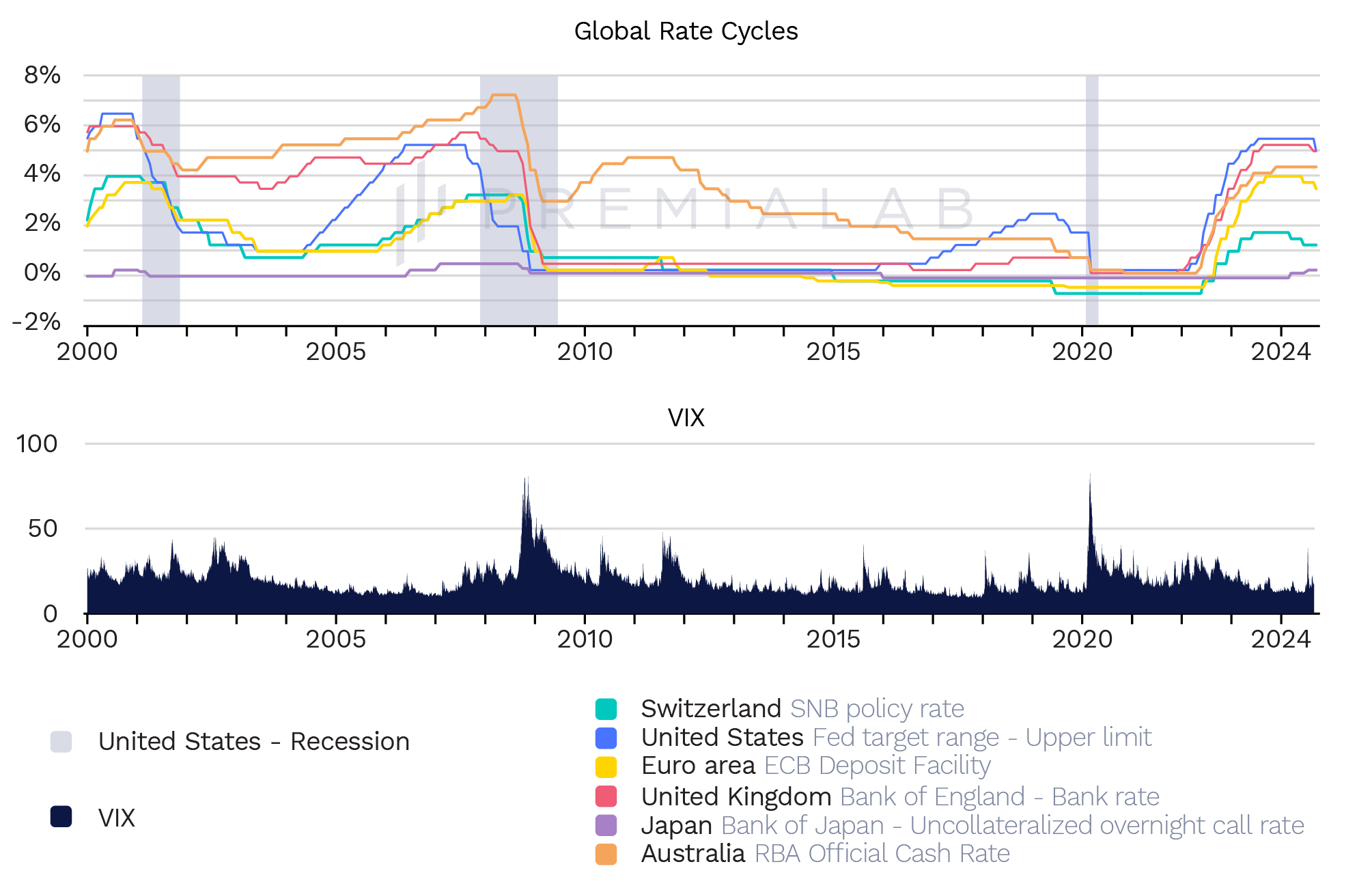

With the Federal Reserve lowering interest rates by another 25 basis points, from 4.75% to 4.5% in December, the market moves further into a deepening monetary easing cycle. Historically, rate cuts follow periods of economic uncertainty or slowing growth; however in this case we see the Fed cutting rates during a period of near full employment. This is unusual because it contrasts with traditional economic conditions prompting rate cuts, suggesting the Fed is taking balancing combatting inflation with pre-emptive measures to mitigate a potential economic downturn. As investors navigate this new regime, it’s crucial to review past easing cycles. Here we analyse the performance of Premialab Pure Factors® during both the 2007 and 2019 rate cuts cycles, providing insights into past factor performance, in particular volatility and trend, to help contextualize the current cycle.

In this article we compare the factor performance for the quarter following the first rate cut in 2007, 2019 and 2024.