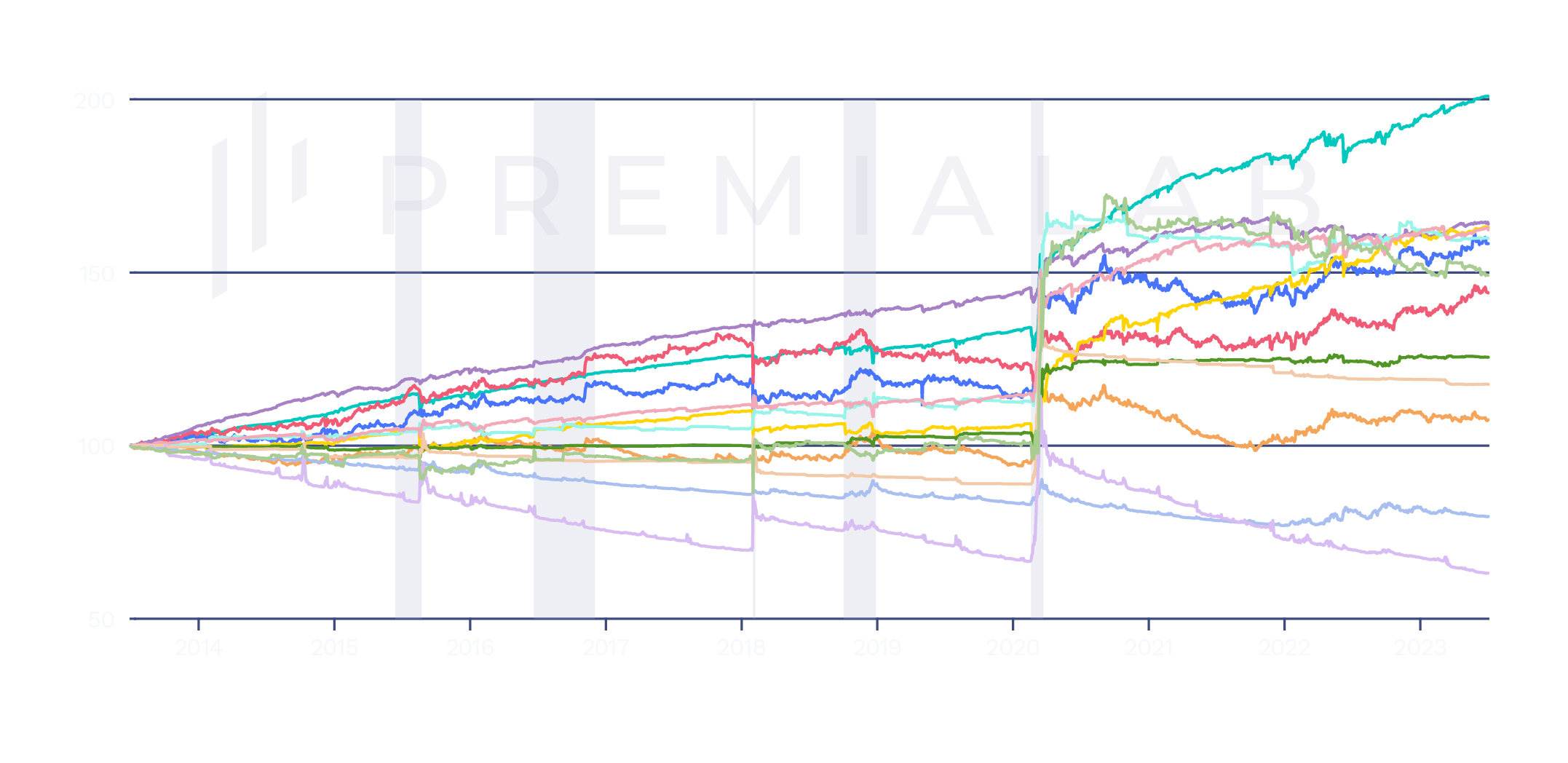

Over the past few years, the financial markets have experienced significant volatility, ranging from the all-time high in 2021 to sudden fluctuations triggered by geopolitical events, high inflation and supply-demand issues. To navigate these turbulent headwinds, investors are increasingly turning to Quantitative Investment Strategy (QIS) based risk mitigation frameworks. These frameworks enhance portfolio resiliency and foster a defensive stance with balanced risk-mitigating profiles.

Constructing a risk mitigation analytical framework is a cumbersome exercise as it involves a range of distinct systematic indices, each with its own implementation characteristics.

We therefore provide a detailed analysis of tail-hedging within the US equity market, emphasizing rule-based strategies that employ derivatives on US equity and the VIX index. Through this analysis, we have developed a comprehensive taxonomy of the most effective defensive implementations. This taxonomy offers investors a thorough understanding of the reactivity, response magnitude, and correlation of these strategies with respect to stress events.

Unlock the potential of tail-hedging and systematic quantitative investment strategies to navigate the complexities of the US equity market and effectively mitigate your portfolio risk.