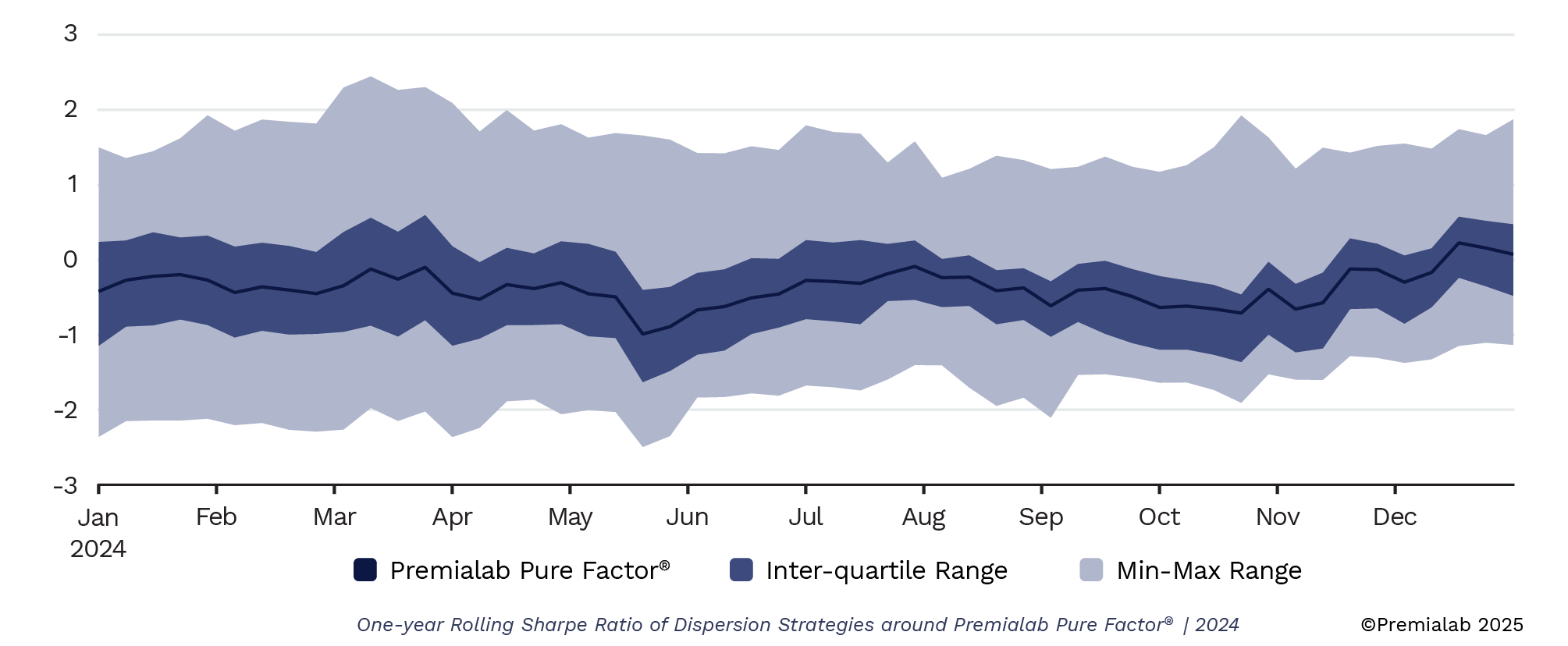

A recent Risk.net article explores the growing momentum behind equity dispersion trades. The piece highlights how Quantitative Investment Strategies (QIS) continue to drive investor interest. In the article, Premialab data reveals that the number of dispersion strategies on its platform more than tripled in 2024, with around half reflecting the increasingly popular gamma neutral format. “It highlights a growing preference for defensive exposures in volatile markets,” said Adrien Geliot, CEO of Premialab.

“The offering has evolved,” says Premialab’s Geliot. “The main variations used to come from the risk neutrality such as vega, gamma or delta neutral, or the delta hedging approach, rebalancing frequency and maturity of underlying options. Now we see strategies embedding adjustments to enhance the carry properties.”

To explore how QIS strategies can enhance your investment approach, please feel free to contact us.