The 2024 U.S. election has added a new layer of uncertainty to financial markets, as investors assess the implications of the shifting political landscape on economic policy and market dynamics. Historically, the combination of presidential and congressional control has played a crucial role in shaping fiscal and regulatory agendas. A unified government, where one party holds the presidency and majorities in both the Senate and the House, often leads to more predictable policy implementation. Conversely, a mixed government can result in legislative gridlock but may also moderate extreme policy shifts. This interplay between the executive and legislative branches can promp a reassessment of investment strategies, particularly in quantitative and factor investing, as market participants anticipate changes in US tax policy, deficit spending, and overall regulation.

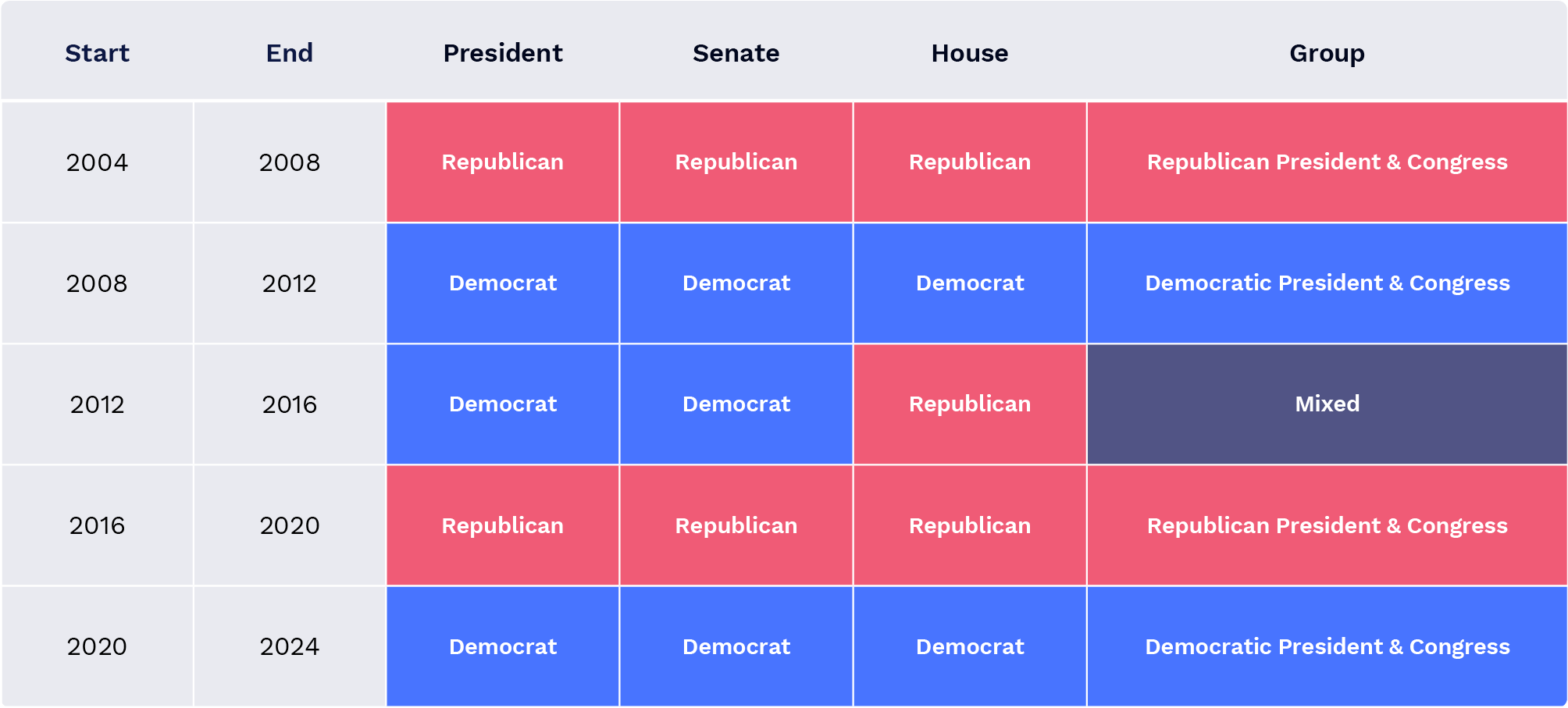

To analyse this impact through a factor lens we first divide historical regimes based on the party of the Presidency, Senate and the House: